SHAREHOLDER

RETURN

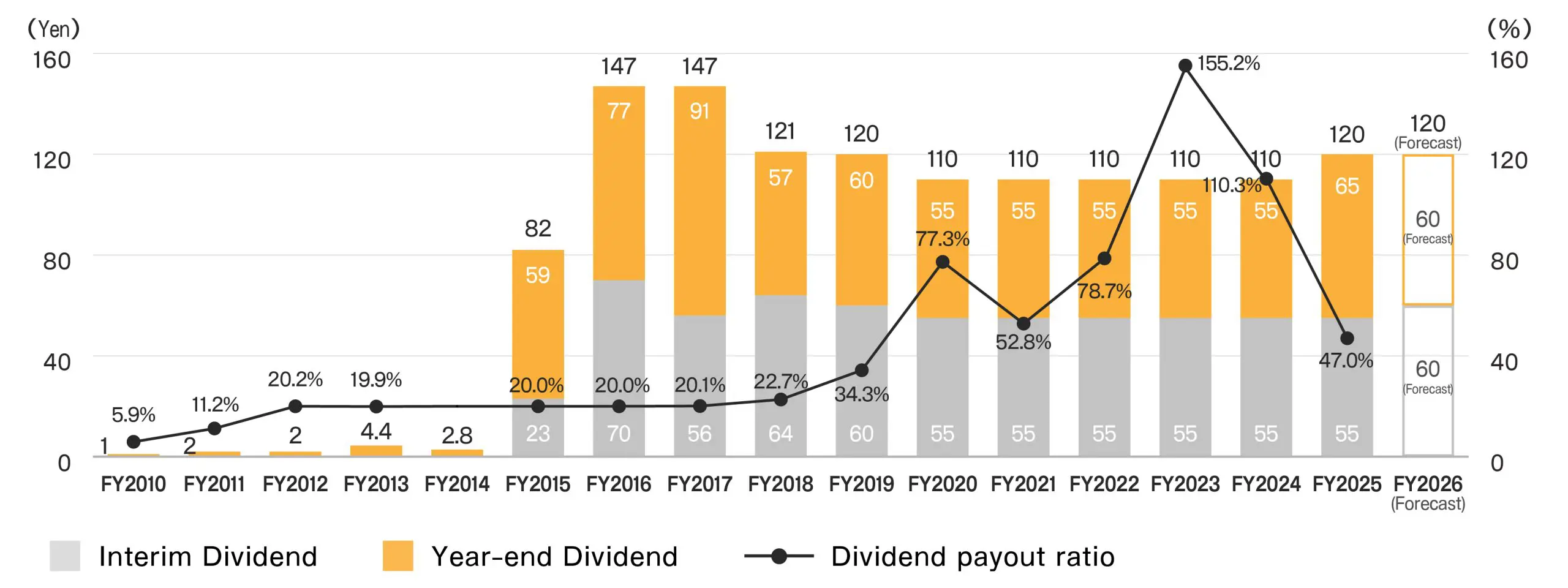

We recognize the importance of returning profits to shareholders, and our basic policy for dividends is to aim for a consolidated dividend payout ratio of 20% or a dividend on equity (DOE) of 5%, while aiming for a sustainable increase in corporate value by investing in business development, research and development, mergers and acquisitions, and other activities necessary for future growth. We've adopted a new policy that includes the repurchase additional treasury shares when the total return ratio is below 100% until we achieve a return on equity (ROE) level that exceeds the recognized cost of shareholders' equity on a three-year average. Our policy is to hold treasury stock at approximately 5% of the total outstanding shares, and to retire any excess shares. We will continue to return profits to our shareholders by taking into consideration each fiscal year's financial results and reviewing our dividend policy, while aiming to continuously increase corporate value. Currently, we pay out dividends twice a year through an interim dividend and a year-end dividend.

Our company does not offer a shareholder benefit program.