SUSTAINABILITY

Our Officers

Appointment policy and nomination procedure for directors

The following is our policy regarding the appointment of director candidates (except outside directors).

1. Proposals for the position of director (except outside directors) are given considering both the diversity and appropriate size of the Board of Directors, with directors possessing a good overall balance of the knowledge, experience, and abilities to efficiently fulfill their roles and responsibilities.

2. Proposals for the positions of director (except outside directors) who are to be in charge of business executions are given for the persons who can make forward-looking, accurate, appropriate, and swift business decisions and executions to help the Company achieve continual growth and higher corporate value over the medium to long term.

Director candidates (except outside director candidates) are selected in accordance with this policy, and final decisions are made by a resolution of the Board of Directors after deliberation by the Nomination and Compensation Committee.

Nominations for outside directors are given considering both the diversity and appropriate size of the Board of Directors, with directors possessing a good overall balance of knowledge, experience, and abilities.

Reasons for candidate nomination / meeting attendance

Three of the seven members of the Board of Directors and all three members of the Audit and Supervisory Board are outside members. Outside directors are expected to provide advice and supervision from an independent perspective, while outside ASB members are expected to provide objective auditing of job performance without being influenced by directors. Outside directors and outside Audit and Supervisory Board members thus ensure the effectiveness of management monitoring systems.

| Title | Officer | Reason for Appointment | Board of Directors’ Meeting Attendance (FY2025) |

Audit & Supervisory Board Meeting Attendance (FY2025) |

||

|---|---|---|---|---|---|---|

| Director | Koki Kimura | Koki Kimura has demonstrated strong leadership since becoming a corporate officer in 2014 and has made a great contribution to the Group’s improved performance, while also leading efforts to improve the corporate value of the Group after assuming the office of President and Representative Director in June 2018. The Company’s Board of Directors selected Koki Kimura to continue as a director specifically for outstanding leadership, skill in the formulation and coordination of managerial strategy, insights into marketing strategy, and ability to promote corporate governance. These qualities stand to strengthen the Board of Directors and promote further growth of the Group. |

16/16 meetings (100%) | - | ||

| Kohei Shimamura | Kohei Shimamura has successively held a number of positions in the Company’s administrative divisions, including the corporate planning and corporate management divisions, is in charge of accounting, finance, and investor relations functions, among other functions, as an incumbent CFO, and has an abundance of knowledge and experience in planning of managerial strategy and enhancement of management that is conscious of capital costs within MIXI Group. Kohei Shimamura has been selected as director in order to utilize his knowledge and experience to strengthen the function of the Company’s Board of Directors, especially with respect to the formulation of managerial strategy, organizational and human resource development, promotion of M&A and PMI, promotion of risk management from the perspective of finance and accounting, and promotion of corporate governance, in order to promote further growth of MIXI Group. | - | - | |||

| Tatsuma Murase | Tatsuma Murase has held a number of posts within technical divisions of the Company, including development divisions, making them able to give a technical perspective through their abundance of knowledge and experience. The Company’s Board of Directors selected Tatsuma Murase to continue as a director specifically for their knowledge and experience in the areas of management strategy formulation, organizational and human resource development, management promotion (in the areas of business strategy, marketing strategy, and technology and research), and promotion of the technological aspects of risk management. These qualities stand to strengthen the Board of Directors and promote further growth of the Group. |

16/16 meetings (100%) | - | |||

| Kenji Kasahara | As founder of the Company, Kenji Kasahara served as the President and Representative Director for many years in the past and has extensive knowledge and experience in relation to the management and overall business of the Group. Even after stepping down from the office of the President and Representative Director, he has, as a person who exemplifies the Company’s corporate philosophy, led the development of new businesses for the Company based on the knowledge and experience they have accumulated. The Company’s Board of Directors selected Kenji Kasahara to continue as a director specifically for their knowledge and experience in the areas of management strategy formulation, and deep understanding of the corporate philosophy as well as management promotion in the areas of business strategy, marketing strategy, and technology and research. These qualities stand to strengthen the Board of Directors and promote further growth of the Group. |

16/16 meetings (100%) | - | |||

| Akihisa Fujita |

With business management experience, including advertising and digital media business and tourism-related business, Akihisa Fujita possesses an abundance of experience and extensive expertise related to corporate activities. With this in mind, we deem them to have made appropriate contributions in areas including managerial decision-making and the supervision of business executions. The Company’s Board of Directors has selected Akihisa Fujita to continue as an outside director in the anticipation that they will utilize past experience and expertise to strengthen the functions of the Board of Directors, namely by formulating management strategies, promoting management from the perspective of business and marketing strategies, providing recommendations regarding M&A and post-merger integration, promoting corporate governance, and supervising managerial matters to further growth of the Group. |

16/16 meetings (100%) | - | |||

| Hiromi Watase |

Hiromi Watase has been engaged in corporate management as a manager for a number of companies and has a wealth of experience in providing management support, notably in the creation of new businesses, and has abundant experience and broad knowledge of corporate activities. With this in mind, we deem them to have made appropriate contributions in areas including managerial decision-making and the supervision of business executions. The Company’s Board of Directors has selected them to continue as an outside director in anticipation that they will utilize past experience and expertise to strengthen the functions of the Board of Directors, namely by formulating management strategies, promoting management from the perspective of business and marketing strategies, providing recommendations regarding creating new businesses, promoting corporate governance, and supervising managerial matters to further growth of the Group. As they do not fall into any of the categories for determining independence stipulated by the Tokyo Stock Exchange, as required by said stock exchange, or the ones stipulated by the Company, we have determined that there is no risk of conflict of interest with general shareholders and have designated them as an independent officer. |

12/12 meetings (100%) | - | |||

| Toshiaki Kawai |

Toshiaki Kawai has been selected as outside director in the anticipation that he will utilize his experience and expertise to fulfill the role of strengthening the function of the Company’s Board of Directors, especially with respect to the formulation of managerial strategy, management promotion from the perspective of business and marketing strategies, making recommendations regarding organizational and human resource development, promotion of corporate governance, and supervising the execution of operations and the like, in order to promote further growth of MIXI Group. | - | - | |||

| Yuichiro Nishimura |

Yuichiro Nishimura has knowledge and experience in the areas of human resources and general affairs through their work at automobile and automobile parts manufacturers, and has been selected as an outside ASB member to strengthen the Company’s auditing system, a s well as the function of the Company’s Board of Directors through risk management and promotion of corporate governance utilizing his expertise in his field of specialization. | 16/16 meetings (100%) | 19/19 meetings (100%) | |||

| Nozomi Ueda |

Nozomi Ueda has been selected as an outside ASB member because she possesses specialized expertise related to corporate governance and compliance,and she also has specialized knowledge and experience as an attorney, which she will use to strengthen the Company’s auditing system,as well as to strengthen the function of the Company’s board of directors through risk management and promotion of corporate governance utilizing her expertise in her field of specialization. | 16/16 meetings (100%) | 19/19 meetings (100%) | |||

| Sumiko Takayama |

Sumiko Takayama, having previously served as an officer for various corporations, not only has abundant insight and experience in corporate activities, but can also utilize their specialized knowledge and experience as a certified public accountant, and has been selected as an outside ASB member to strengthen the Company’s auditing system using their aforementioned knowledge and experience, as well as strengthen the functions of the Board of Directors in areas such as corporate governance and risk management using knowledge from their field of expertise. As they do not fall into any of the categories for determining independence stipulated by the Tokyo Stock Exchange, as required by said stock exchange, or the ones stipulated by the Company, we have determined that there is no risk of conflict of interest with general shareholders and have designated them as an independent officer. |

16/16 meetings (100%) | 14/14 meetings (100%) | |||

Criteria for judging independence of outside officers

Based on a reasonable amount of research by MIXI and the criteria for judging independence prescribed by the Tokyo Stock Exchange, MIXI deems its outside officers and outside officer candidates to have sufficient independence as long as they do not fall into any of the following categories.

- Business executives of MIXI or one of MIXI’s subsidiaries

- Business executives of counterparties of MIXI that exceed the transaction standard set by MIXI (Note 1)

- Consultants, accountants, or jurists that receive large amounts of cash or other assets aside from officer compensation (Note 2)

- If the recipient is a corporate body or organization, then this refers to members of that corporate body or organization

- Principal shareholders of MIXI (Note 3) and their business executives

- Business executives of major lenders and banks that work with MIXI

- Business executives of MIXI’s book runners

- Business executives of auditing firms that work with MIXI

- Close relatives of individuals that fall into categories 1-3 (Note 4)

- Individuals that fell into categories 1-7 within the past 3 years

Note 1: “Counterparties of MIXI that exceed the transaction standard set by MIXI” means counterparties whose transactions with MIXI exceed 2% of MIXI’s consolidated net sales.

Note 2: The value of “large amounts of cash or other assets aside from officer compensation” is an amount more than or equal to 10 million JPY for individuals, or an amount more than or equal to 2% of their consolidated net sales for corporate bodies or organizations.

Note 3: In accordance to Article 163, Paragraph 1 of the Financial Instruments and Exchange Act, “principal shareholders of MIXI” means any shareholder that holds voting rights (excluding those specified by a Cabinet Office Ordinance in consideration of the manner of acquisition, holding thereof, or other circumstances) exceeding 10 percent of the voting rights held by all shareholders, whether held in their own name or that of another person, or under a fictitious name.

Note 4: “Close relative” means any relative up to the second degree.

Composition of officers

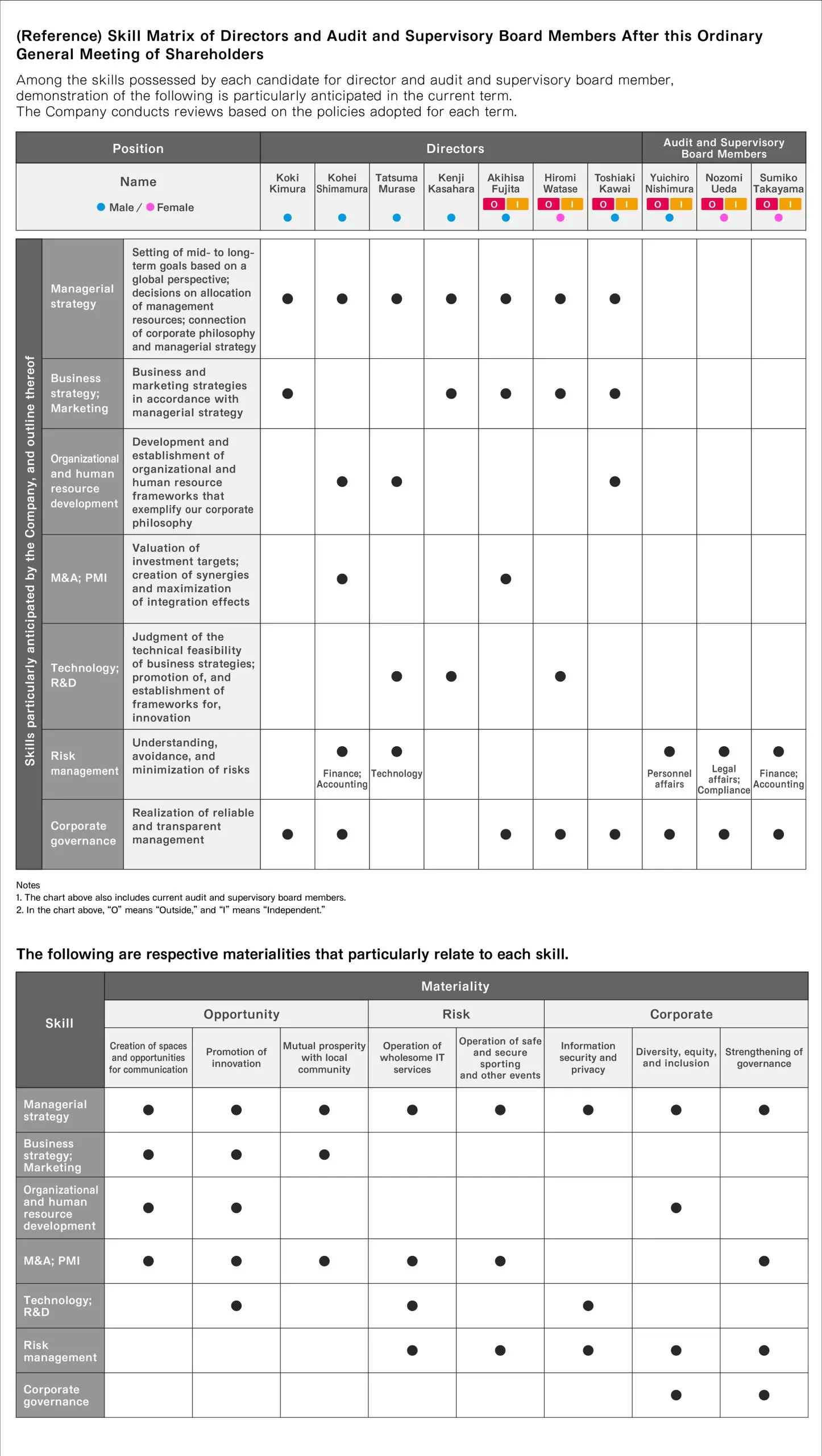

Skill Matrix of Directors and ASB members

*The Company has established eight material issues (material social issues to be addressed by the Company) as themes to be adopted through corporate activities.

For details, please see “Material issue information (evaluation indicators and performance)”(https://mixi.co.jp/en/sustainability/materiality_sdgs/).

Policy and procedure for deciding officers’ compensation

The following is our policy regarding compensation for directors.

Basic policy:

Our basic policy for director compensation is to provide a sound incentive for continuous growth by establishing an appropriate ratio between cash compensation and stock compensation.

Compensation system:

Based on the basic policy, compensation for directors (excluding outside directors) is provided in two forms: “cash compensation” paid on a monthly basis; and “share-based compensation (share compensation-type stock options)” delivered once a year after the ordinary general meeting of shareholders for the relevant fiscal year. Specifically, compensation is composed of the three elements “basic compensation,” “share-based basic compensation,” and “outcome-based compensation”. With respect to each form of compensation, “basic compensation” is “cash compensation,” “share-based basic compensation” is “share-based compensation (share compensation-type stock options),” and “cash compensation” paid on a monthly basis or “share-based compensation (share compensation-type stock options)” delivered once a year after the ordinary general meeting of shareholders for the relevant fiscal year may be chosen as “outcome-based compensation.” The ratios for base compensation, stock-based compensation, and performance-based compensation are individually designed based on the roles, responsibilities, and positions of the respective directors with reference to the Company’s past results and shared compensation data of companies listed on the Tokyo Stock Exchange compiled by specialist companies. They are then deliberated on by the Nomination and Compensation Committee and finalized by the Board of Directors.

From the perspective of ensuring adequate supervisory functions for the execution of business, the compensation structure for outside directors is composed solely of cash compensation.

There is no retirement bonus system for directors.

Details and methods of determining compensation:

Details of director compensation and methodology for determining director compensation are as follows:

Compensation for directors (excluding outside directors)

The amount of base compensation and stock-based compensation is determined according to the presence or absence of representation rights as well as factors such as the roles, responsibilities, and positions of directors in the Company. With respect to the stock-based compensation, for the purpose of promoting initiatives to enhance corporate value over the medium- to long-term and sharing value with the Company’s shareholders, the Company will issue restricted shares (common shares of MIXI), the transfer of which will be restricted from the date of issue until the retirement or resignation from the positions of director, senior corporate officer, corporate officer, or employee (including positions after changes in position titles. This also applies below.) of the Company, its subsidiaries, or affiliates, and will provide monetary compensation claims for granting said transfer-restricted shares. With respect to the performance-based compensation, an evaluation ratio is determined beforehand based on the position and responsibilities, and an overall evaluation is made of the company’s performance in the previous period as well as each individual’s achievement in their expected role. The base amount of the performance-based compensation, which is determined in accordance with the base compensation, is multiplied by a coefficient based on overall evaluation in order to determine the compensation amount. In addition, the performance evaluation shall be based on the company-wide net sales, operating income, and net income for the current period, comparing actual results against forecasts, and YoY change. Furthermore, if stock-based compensation (restricted stock)—issued once a year after the Ordinary General Meeting of Shareholders—is selected as performance-based compensation, the details of such compensation are as the same as aforementioned, and monetary compensation claims equal to the amount of the performance-based compensation determined in the previously described ways shall be provided.

Total compensation, amount of compensation by type, and number of eligible officers by category of officer (FY2025 results)

| Category | Number of Officers Eligible for Compensation | Compensation Amount, Etc. by Type (Millions of Yen) | Total Compensation (Millions of Yen) | ||

| Basic Compensation | Share-Based Basic Compensation | Outcome-Based Compensation | |||

| Director (Outside Director) | 8 (4) | 148 (27) | 79 | 149 | 378 (27) |

| Audit and Supervisory Board Member (Outside ASB Member) | 4 (4) | 29 (29) | ー | ー | 29 (29) |

Note: further details are available on page 36 of CONVOCATION NOTICE FOR THE 25TH ORDINARY GENERAL MEETING OF SHAREHOLDERS.

Total amount of consolidated compensation by director (FY2025 results)

| Name | Officer Category | Company Category | Total Consolidated Compensation by Type (Millions of Yen) | Total Consolidated Compensation (Millions of Yen) | ||

| Basic Compensation | Share-Based Basic Compensation | Outcome-Based Compensation | ||||

| Koki Kimura | Director | Filing company | 60 | 39 | 59 | 159 |

Note: The above information is limited to those whose total consolidated compensation is 100 million yen or more. Further details are available on page 58 of the annual securities report for the fiscal year ended March 31, 2025 (Japanese only).

Compensation for outside directors

The amount of compensation in cash is decided in accordance with the title and the like of the individual in question, taking into consideration compensation market survey data for domestic listed companies and the like provided by external professional organizations.

Decision process:

In order to protect objectivity and transparency, the compensation system and decision process for directors (excluding outside directors) is discussed by the Nomination and Compensation Committee (consisting of all outside directors, the Representative Director, and one internal director) and based on those deliberations, voted on by the Board of Directors.

The decision on compensation for individual directors is made by resolution of the Board of Directors. For directors other than outside directors, the Nomination and Compensation Committee must deliberate before a resolution is adopted by the Board of Directors.

At the 17th Ordinary General Meeting held on June 28, 2016 and as adjusted in the 24th Ordinary General Meeting of Shareholders held on June 21, 2023, it was decided that remuneration for directors, including monthly remuneration and monetary compensation claims for granting stock-based (restricted shares), shall not exceed 1 billion JPY per year (and no more than 100 million JPY for outside directors).

As their role as ASB members is to audit for compliance with laws and regulations, compensation for ASB members consists of cash compensation only.