SUSTAINABILITY

Corporate Governance

Basic Approach to Corporate Governance, Capital Structure, Corporate Profile, and Other Basic Information

1. Basic Approach

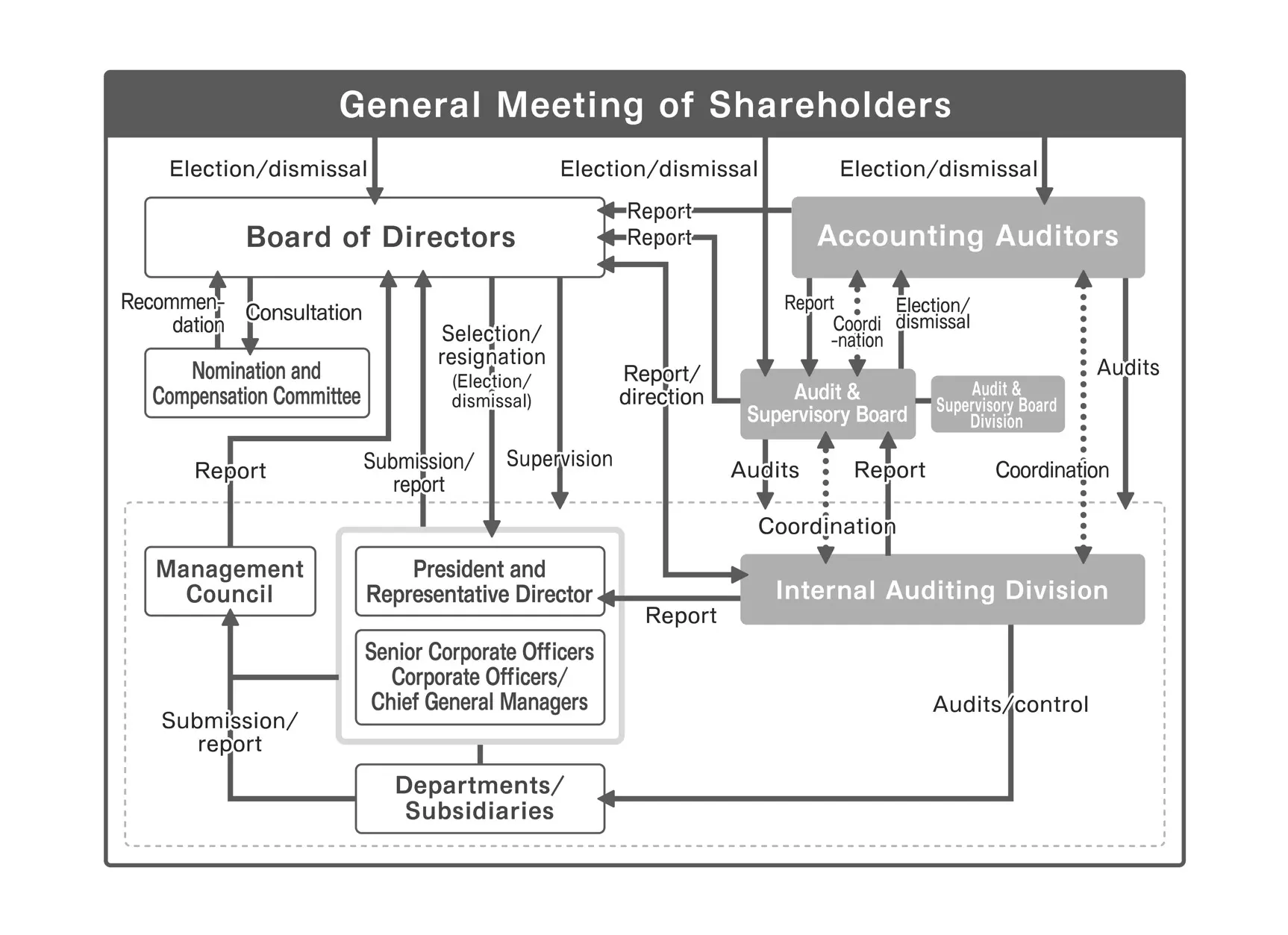

We recognize corporate governance as a means for maximizing corporate value. As such, we reorganize our organizational structure when appropriate to accommodate the expansion of our business ventures, to manage profits and losses of each of our businesses, and to further clarify authority and responsibilities. We also focus on further enhancing the capabilities of the Board of Directors (which serves as the Company’s decision-making body), of Audit & Supervisory Board members (hereinafter, “ASB members”) and the Audit & Supervisory Board to monitor directors’ performance of their duties, as well as on improving our internal control systems in order to prevent improprieties in business activities.

To continually increase management transparency and fairness, we appropriately present statutory disclosure documents and actively conduct IR activities using our website and other means.

Corporate governance structure

| Organization | Company with Audit & Supervisory Board |

|---|---|

| Number of directors | 7 directors, 3 of whom are outside directors – Outside director ratio: 42% (3 of 7) |

Board of Directors

The Board of Directors has seven members, consisting of four internal directors (currently without female directors) and three outside directors (including one female director). In principle, Board of Directors’ meetings are held once a month, constituting a system that allows speedy and efficient decision-making. For greater clarity of the managerial responsibilities of directors and create a management system that is able to respond swiftly to changes in the management environment, the term of service for directors is prescribed as one year.

During the fiscal year ended March 31, 2025, the Board of Directors met 16 times, and matters relating to material business execution (such as formulation of the shareholder return policy, execution of large-scale M&A transactions, formulation of reoccurrence prevention measures based on a case of misconduct at a subsidiary of the Company, development of business execution systems, and revision of important rules, including rules on administrative authority and the like) set forth in laws and regulations or internal rules were determined, qualifications for CEO as part of a succession plan were formulated, and discussions were conducted based on the managerial strategy and reports on the status of execution of duties. In addition, under the policy of strengthening the strategy- and supervision-related functions of the Board of Directors, the Board of Directors endeavored to enhance discussions, such as by reviewing the composition of items to be monitored regularly with a focus on holistic and strategic perspectives and improving the quality of submitted materials. In addition, the Board of Directors regularly monitored the status of communication with investors and the status of sustainability-related initiatives.

Attendance at meetings of the Board of Directors in the fiscal year ended March 31, 2025 was as follows.

https://mixi.co.jp/en/sustainability/materiality/governance/appointment/

Management Council

Our Management Council, composed primarily of internal directors, conducts key discussions and decision-making related to business operations. In principle, Management Council meetings are held once a week but may be held whenever necessary. Furthermore, necessary information from Management Council meetings is shared with outside officers.

Audit & Supervisory Board

Our Audit & Supervisory Board has three independent outside members (including two female members). We will conduct audits based on our annual plan with cooperation from internal auditors (personnel or divisions) and accounting auditors. The results and details of these audits will be discussed at Audit & Supervisory Board meetings held at least once a month. Based on these discussions, we will provide appropriate advice to the Board of Directors or individual directors as we strive to ensure sound and efficient management.

Nomination and Compensation Committee

We have established a Nomination and Compensation Committee. The objectives of the committee are to strengthen transparency and objectivity by obtaining the opinions and advice of outside directors before the Board of Directors deliberates matters related to individual nomination proposals and compensation of directors (excluding outside directors).

The scope of deliberations of the Nomination and Compensation Committee is as follows:

(1) Nominations for and appointments of director candidates along with HR policy proposals

(2) Basic policy proposals for the director compensation system

(3) Compensation condition proposals for directors (including calculation method)

(4) Specific compensation proposals for individual directors (including calculation method)

(5) Other matters requested by the President and Representative Director

Composition of the Nomination and Compensation Committee

Committee Chair (outside director): Akihisa Fujita

Committee Member (outside director): Hiromi Watase

Committee Member (outside director): Toshiaki Kawai

Committee Member (internal director): Koki Kimura

Committee Member (internal director): Kohei Shimamura

During the fiscal year ended March 31, 2025, the Nomination and Compensation Committee met four times to examine director evaluations, individual director personnel proposals, individual director compensation proposals, and director compensation structure. In addition, they discussed individual proposals for senior corporate officer, corporate officer, and C-level positions, as well as succession plan initiatives.

The Nomination and Compensation Committee for the fiscal year ended March 31, 2025 consisted of the following five members (the president and representative director as chair, and all three outside directors and one internal director as members), with the attendance of each member as follows.

| Committee Chair (internal director): Koki Kimura | 100% (4/4 meetings) |

| Committee Member (outside director): Satoshi Shima | 100% (4/4 meetings) |

| Committee Member (outside director): Akihisa Fujita | 100% (4/4 meetings) |

| Committee Member (outside director): Hiromi Watase | 100% (3/3 meetings) |

| Committee Member (internal director): Hiroyuki Osawa | 100% (4/4 meetings) |

(Notes) 1. Figures in parentheses indicate the number of meetings attended divided by the number of meetings held during the term of office.

Evaluation of the effectiveness of the Board of Directors

The Company conducts yearly self-evaluation and analysis of the effectiveness of its Board of Directors with the aim of enhancing its capabilities and maximizing corporate value.

Method for evaluating the effectiveness of the Board of Directors

Between January and February 2025, a survey was conducted among all directors and ASB members. We ensured anonymity by adopting a method where participants respond directly to an external organization. The results of the survey were analyzed, discussed, and evaluated at the Ordinary Board of Directors Meeting held in April 2025.

Survey focus points

– Composition of the Board of Directors

– Management of the Board of Directors

– Board of Directors discussions

– Monitoring functions for the Board of Directors

– Director and ASB member support systems

– Discussions with shareholders (investors)

Analysis/evaluation of Board of Directors effectiveness survey results:

The responses to the questionnaire were generally positive and respondents believe that the Board of Directors’ effectiveness as a whole is adequately ensured. Highly evaluated points have been listed below:

- Frequency of board meetings and deliberation time are appropriate, and free, open-minded, and constructive discussions and exchanges of opinions take place.

- The Board of Directors is fully aware of and discusses how management strategies and plans are consistent with the Company’s sustainable growth and the creation of medium- to long-term corporate value.

- The information necessary for directors and ASB members to perform their duties is provided, including well-supported reporting on financial affairs and feedback regarding dialogue with shareholders and investors.

- The Board of Directors appropriately delegates matters where it is deemed suitable to delegate authority to the president / representative director and the Management Council (a body composed mainly of internal directors which conducts meetings related to business execution), ensuring that sufficient time is secured for the deliberations of the Board of Directors.

- The Management Council’s decisions regarding business execution are in accordance with management strategies.

Along with the above points, the evaluation of the Board of Directors saw improved scores overall compared to the previous fiscal year, especially in areas of focus for improvement. Through these improvement efforts, we confirm that the function of the Board of Directors is being properly fulfilled.

On the other hand, we recognize that there is room for improvement in the monitoring system of subsidiaries by the Board of Directors and the risk detection system for the Group as a whole, and we recognize the need for improvement measures.

Initiatives for improving the effectiveness of the Board of Directors:

Based on evaluations of the Board of Directors from the previous fiscal year, the Board of Directors and Secretariat of the Board of Directors have worked on the following points:

- Optimization of meeting time

Continuing from the previous fiscal year, the Company proceeded with the delegation of authority from the Board of Directors to the Management Council and other bodies for matters deemed as appropriate for such delegation. By reducing the number of agenda items in the Board of Directors’ meetings, we optimized the time allotted for each meeting, ensuring sufficient time for discussion of each agenda item deliberated by Board of Directors. In addition, each agenda item was deliberated in advance by the Management Council or other group. The chairperson shared the content of their deliberations at the Board of Directors’ meetings in order to promote efficient discussions. - Improvement of agenda materials and information sharing methods

Continuing from the previous year, we strived to promote understanding among directors and corporate auditors by sharing an overview of each agenda item and the issues to be discussed in advance. In addition, a discussion forum separate from the Board of Directors’ meetings was established once a quarter for the purpose of sharing information on management strategies and agenda items to be presented to the Board of Directors, which allowed time for in-depth discussions of those agenda items. - Strengthening discussion on strategies / enhancing discussion on growth in the medium to long term

Regular monitoring of the progress of the ongoing medium-term management plan was conducted to strengthen discussions on how to improve corporate value over the medium to long term. In addition, to facilitate management that emphasizes profitability and capital efficiency, we have formulated a management plan that fully accounts for ROE, promoted strategic decision making, and formulated a shareholder return policy with an awareness of the cost of shareholders’ equity. - Accelerating the sharing of financial risk information

To promptly identify risk information related to impairments and other issues concerning subsidiaries and affiliated companies, we strengthened interdepartmental collaboration and reported to the Board of Directors on a quarterly basis.

Measures to be taken in the future

For the future, we recognize that establishing an effective information provision system and enhancing discussions aimed at medium- and long-term growth are ongoing efforts. Considering the need to promote a management style which has a view toward global expansion, as well as the occurrence of an instance of impropriety at a subsidiary, we also recognize that finding a suitable structure for our Board of Directors and strengthening monitoring related to Group governance are matters we need to focus on.

Using the results of this evaluation, we will continue striving to improve the effectiveness of the Board of Directors as a whole.

Internal control

We are developing our internal structure with the basic policies of our internal control system as its base.

The Group has established our MIXI Group Business Conduct Guidelines and Code of Ethics that emphasize the importance of compliance and ensures that all officers and employees are fully aware of what that entails through an information system, training, and the like. In addition, the Group has established an internal reporting system as a check against activities that are illegal or go against our Articles of Incorporation and to prevent scandals, and has prepared a system to exclude antisocial forces.

For our information management system, we have established rules for information management, clarified denotation for important documents and how they should be stored, and created a system for safely saving and managing personal information, important business secrets, and information regarding director work activities.

Overview of Timely Disclosure System

1. Our stance and policy on timely disclosure

We believe that timely and appropriate disclosure of information to shareholders, investors, local communities, and other stakeholders will promote greater understanding of the Company, allowing proper evaluation of the Company. We are always working to improve our internal systems to ensure that we can disclose corporate information in a timely, accurate, and fair manner from the perspective of our stakeholders.

We also ensure that our officers and employees are educated on subjects such as insider trading and information subject to timely disclosure through internal training programs both when they join the Company and annually.

2. Internal system for the timely disclosure of corporate information

To ensure thorough internal management of corporate information and appropriate and timely disclosures, several specialized sections have been set up under the direction and supervision of the management and company-wide initiatives have been launched. In order to improve the accuracy and content of disclosure materials, we have established a system in which multiple sections mutually check each other’s work while confirming the quality of our internal control system through regular internal audits. We also have auditors regularly conduct quality and legality checks of our accounting information. In addition, the Company’s management and specialized departments have established a system in which they collect and report timely and appropriate information that follows our disclosure guidelines from our subsidiaries, which is then disclosed if deemed necessary.

3. Procedure for timely disclosure

(1) Of information regarding important decisions and occurrences

The senior corporate officer in charge of the department overseeing IR operations works alongside the IR and Legal Affairs sections to analyze information reported by each part of the Company and the Group’s companies. They then follow the rules regarding timely disclosure, determining whether information needs to be disclosed, what exactly to disclose, the method of disclosure, then disclosing the information promptly.

As a result, any important matters determined subject to timely disclosure are reported to the Management Council or President and Representative Director, then presented to the Board of Directors (directly depending on the level of importance), and promptly disclosed upon approval by the Board of Directors.

(2) Of information regarding financial results

The accounting section shall consult with accounting auditors and outside experts as necessary to make a report regarding carefully examined financial results materials for the senior corporate officer in charge of the department overseeing IR operations and, upon approval of Board of Directors, promptly disclose the information.

4. Method of timely disclosure

The Company discloses corporate information without delay via TDnet and EDINET and also distributes disclosure materials to the press. In addition, the Company posts publicly disclosed corporate information on its website and otherwise strives to provide timely, accurate and fair updates to all shareholders and investors.