SUSTAINABILITY

Risk Factors

MIXI Group recognizes that the following risks could have a great effect on investors’ decisions. It should be noted that future concerns are based on the Company’s judgment as of the 26th Ordinary General Meeting of Shareholders (held on June 26, 2025) and may differ from actual results due to inherent uncertainty.

1. Business environment-related risk

(1) Mobile market

MIXI Group provides various services via smart devices and the expansion of the mobile-related market is a basic condition for business development. However, the introduction of new legal regulations, technical innovation, changes in trends at communications carriers, and other factors may cause rapid and significant changes in the mobile-related market.

(2) Competition

The various services we provide via smart devices are facing severe competition from companies in both Japan and overseas. Heightened competition and the cost of countering this competition may have an impact on the Group’s business, performance, and financial position. If MIXI Group’s users start spending more time on competing services, the demand for our services may decrease.

(3) Technical innovation

Technical innovation and changes in customer needs are rapid in the Internet industry, and new services are being introduced one after another. If MIXI Group is unable to respond to change appropriately and in a timely manner, our competitiveness may decline despite securing outstanding engineers and adopting cutting-edge technology in research and systems.

2. Business-related risk

(1) Response to changes in user tastes, interests, and concerns

As the main users of our services are ordinary mobile users, including young people, user acquisition and retention, frequency of use, and the amount of money spent are highly affected by changes in the users’ tastes. If MIXI Group is unable to accurately identify user needs and provide content that satisfies them appropriately and in a timely manner, the appeal of these services to users may decline.

Sales of paid content in games provided by the Digital Entertainment segment account for the majority of Group revenue, and there is a significant dependence on sales of a specific title (MONSTER STRIKE). Therefore, a decline in the competitiveness of that title could cause a decrease in the number of users, a decrease in the percentage of users of who make in-app purchases, and a decrease in the use of paid content, etc. Moreover, if the popularity of newly developed titles and the number of paying users does not progress as anticipated, it may have an impact on the Group’s business, performance, and financial position.

(2) Dependence on external enterprises for user acquisition

Services in the Digital Entertainment segment are provided via platform providers such as Apple Inc. and Google LLC but maintaining agreements with these providers may become difficult, or changes to their operational policies, fees, etc., may arise. Furthermore, we contract operations to various external enterprises for the development and provision of services, and if relationships with those external enterprises were to deteriorate, it may pose a problem for the maintenance of services and new development.

(3) Global expansion

If MIXI Group is unable to address potential risks that include differences in laws and regulations, political and social circumstances, culture, religion, user preferences, commercial practices in different countries, and exchange rate fluctuations, expected outcomes may not be achieved. When releasing apps for smartphone devices to overseas markets, MIXI Group and its services may not be as accepted as they are in Japan and could be exposed to user criticism in some cases.

(4) Trust and social confidence in MIXI Group and MIXI Group’s products, services, and businesses

Unsubstantiated rumors among users may damage the reputation and trust of MIXI Group and the services the Group provides. This, together with inappropriate or illegal behavior on the part of some malicious users, may cause the safety and reliability of services to drop and a decrease in the number of users. In addition, if an external enterprise to which operations are contracted leaks personal information or commits some other illegal or inappropriate act, the reputation of MIXI Group or its services may decline.

MIXI Group’s brand value may also decline if MIXI Group is unable to make the investments needed to maintain and enhance its brand value or if a competitor establishes a more competitive brand.

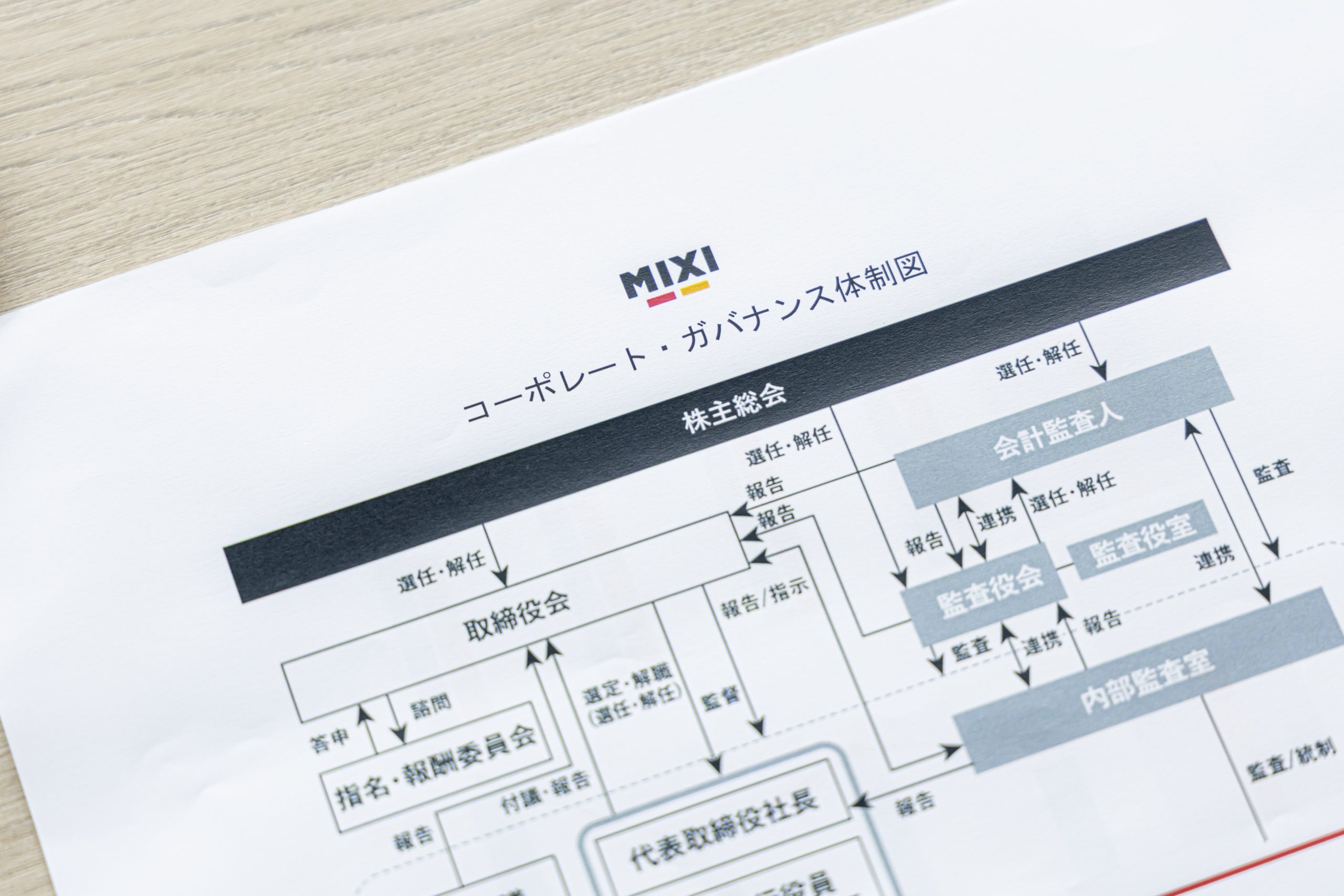

We have established the following system to ensure that managerial decisions take into consideration this kind of reputational and compliance risk.

Establishment of a risk management system and Risk Management Committee

We have established a Compliance Department as well as a corporate officer in charge of risk management and other related matters. We have also formulated a company-wide risk management system that includes the identification of our comprehensive risk status and formulation of prompt response methods after an incident occurs. In addition, chief general managers in charge of business execution and the management of our Group companies consider business risks while executing their duties. In order to manage risks across the organization without relying on specific individuals for business promotion, a system is in place where they regularly report the risks of their respective businesses at designated meetings. Significant business activities exceeding a certain financial threshold are presented at Board of Directors meetings or Management Council meetings and are resolved in accordance with the “Rules on Administrative Authority”.

By expanding the decision-making authority of the Management Council, the Board of Directors will be able to focus on the deliberation of more important matters, and devote themselves to discussions and decisions concerning management strategy and risk management. In addition, a Risk Management Committee, headed by the corporate officer in charge of risk management, has been established as a meeting body to identify, evaluate, and consider measures to address cross-organizational risks in the event of new businesses or M&A. We aim to improve our risk management and compliance system by providing feedback on the outcome of deliberations to business sections and the Board of Directors.

3. Business promotion system-related risk

(1) Securing and developing human resources

If securing and developing outstanding human resources, such as the leaders that become necessary as business expands, does not proceed as planned, MIXI Group’s competitiveness may decline and business expansion may be restricted.

(2) Internal management systems

If the development of adequate internal management systems fails to keep pace with rapid business expansion, etc., the appropriate operation of business and the development of management systems may become difficult.

(3) Information management system

The possibility of leaks, tampering, improper use, etc., of personal and other information held by MIXI Group cannot be completely ruled out. In consideration of this, MIXI Group is enrolled in insurance that covers leaks of personal information, but this may not be able to completely compensate for all such losses. If a situation like this were to arise, the burden of considerable costs for an appropriate response, claims for compensation for damages, and a decline in confidence in MIXI Group, etc., may occur.

4. System-related risk

(1) Continuous equipment and systems investment accompanying business expansion

MIXI Group plans continuous capital expenditure in systems infrastructure, etc., to prepare for future increases in users and access volume. However, if there is a sharp increase in the number of users and access volume exceeding forecasts, it is possible that we could be forced to change the timing, content, and scale of capital expenditure, and the burden of capital expenditure and depreciation costs may increase.

(2) Systems failure and natural disasters

Computer systems may fail due to various factors that cannot be predicted, including temporary overloads due to sudden increases in traffic, interruptions to the power supply, software bugs, failures of external linked systems, computer viruses and external intrusions into computers by illegal means, natural disasters, and accidents.

5. Legal regulation-related risk

MIXI Group’s business is subject to various laws and regulations, as well as the guidelines, etc., of regulatory agencies. It is possible that MIXI Group’s business could be subject to new restrictions or that existing regulations could be strengthened as a result of the establishment or revision of these laws and regulations, the cancellation of approvals or imposition of penalties by regulatory agencies, or the establishment or revision of new guidelines or voluntary regulations.

6. Intellectual property rights-related risk

There is a possibility that intellectual property rights not recognized by MIXI Group have already been established or may be newly established. As a result, MIXI Group may be subject to claims for compensation for damages or injunctions due to infringement of the intellectual property rights of third parties or that there could be claims against MIXI Group for royalties for the intellectual property rights. Furthermore, in system development involving open-source software, unforeseeable reasons may impose restrictions on the use of intellectual property rights.

7. Investment and lending-related risk

MIXI Group invests in expanding our business portfolio with the expectation of realizing business synergies between individual investee companies and MIXI Group or contributions to profits by investee companies. However, anticipated synergies or profit contributions may not be realized, and an impairment may be recorded due to the performance of investee companies. In addition, it is possible that investment capital cannot be recovered if an unlisted company into which an investment partnership (fund) invests suffers a decline in performance.

8. Operational alliance and M&A-related risk

Regarding the implementation of operational and capital alliances and M&A with companies that are highly compatible with MIXI Group’s services, if integration with an acquired company or the development and strengthening of relations with an alliance partner do not progress as planned, or if the business synergies, etc., initially anticipated due to the integration or alliance cannot be obtained, or if the operational alliance in question is dissolved for any reason, it is possible that profit commensurate with investment, time, and other expenses may not be returned. Also, the acquisition of companies, etc. results in the recording of substantial goodwill in the balance sheet and if the expected effects are not realized due to factors such as changes in the business environment or competition, it will result in the impairment of this goodwill.

9. New business-related risk

If additional expenditure aimed at creating and developing new services and new businesses arises, it is possible that profitability may decline. Also, in cases where MIXI Group has limited experience concerning a new service or business, operations may not be able to proceed smoothly due to this lack of experience. If the development of new services and businesses does not proceed as planned, or if plans are canceled, or if the new businesses are not able to achieve their anticipated profitability, etc., it may affect MIXI Group’s business, performance, and financial position.

10.Trends in financial results

Since the fiscal year ended March 2017, there has been a downward trend in revenue from MONSTER STRIKE due to factors such as a decline in active users, and the consolidated financial results have continued to show a decline in both revenue and profit through the fiscal year ended March 2020. Although we will continue to implement policies that include measures to raise and maintain the profitability of MONSTER STRIKE and develop our sports and lifestyle businesses, if these efforts are not executed in an appropriate and timely manner, or if they do not yield results, it may have an impact on the Group’s business, performance, and financial position.